Viva Network - Blockchain Based Mortgage Crowdfunding Platform

Viva network is designed to remove the barriers existing with mortgage borrowings. Viva is the decentralized Blockchain based ecosystem that connects mortgage borrowers with worldwide investors. This removes the requirement of the bankers and opens the door to borderless, Blockchain secured cloud platform.

Assume that you want to buy a new house. But the local bankers present you lots of conditions with a higher interest rate. Viva makes this process easier. No painful approval process. When you made the application, the system will automatically run the third party assurance services and a comprehensive internal credit approval process. Then the mortgage will be uploaded to the network. Global crowdfund providers will grant the amount you request. This network is designed to enhance the following three key sectors of the current mortgage process.

Mortgage Financing – Viva network will facilitate the users to obtain a mortgage loan from worldwide crowd leaders. Institutional or private lenders can act as crowd leaders.

Residential Property Valuation – The current property valuation process will be enhanced with the Blockchain based innovative Real Value 2.0 application.

Credit Scoring – Users will be provided with transparent and trackable digital identification known as “-ID”. Using that ID users can build own Viva credit profile using “V-Score” application.

Viva mortgage process is followed by following steps.

Initial application – As the first step borrower should submit a full application with supporting documentation in standardized formats.

Verification – Professionals deployed in the network will perform an in-house due diligence on asset value.

Conditional Approval – Based on the documents submitted the initial approval will be provided through Viva hub.

Conditional Approval – Based on the documents submitted the initial approval will be provided through Viva hub.

Home appraisal – An independent valuation will be done by the independent appraisers.

Title search – Title search will be conducted to ensure that there are no attached liens on the property.

Standardized Viva recommended terms – Based on the profile analysis, the recommended terms and conditions will be determined.

Proposed terms – Applicants can discuss further the proposed terms

Final Approval – All the proposed terms should pass minimum qualification test for the purpose of listing on crowdfunding network.

Viva hub is the main actor of this process. It consists of a web-based application that designed to complete all of above steps.

Viva network uses VIVA Tokens as their official currency which is backed by Ethereum network. This will be the currency which would be used in platform transactions. The total number of tokens will be distributed among the platform participants as follows.

75% will be distributed through ICOs. The pre-ICO is now open. Participants can earn 30% bonus in pre-sale.

5% will be distributed to the team while 3.5% distributing among the advisors

10% will be reserved for future users

Remaining 3.75% will be utilized for marketing purposes

5% will be distributed to the team while 3.5% distributing among the advisors

10% will be reserved for future users

Remaining 3.75% will be utilized for marketing purposes

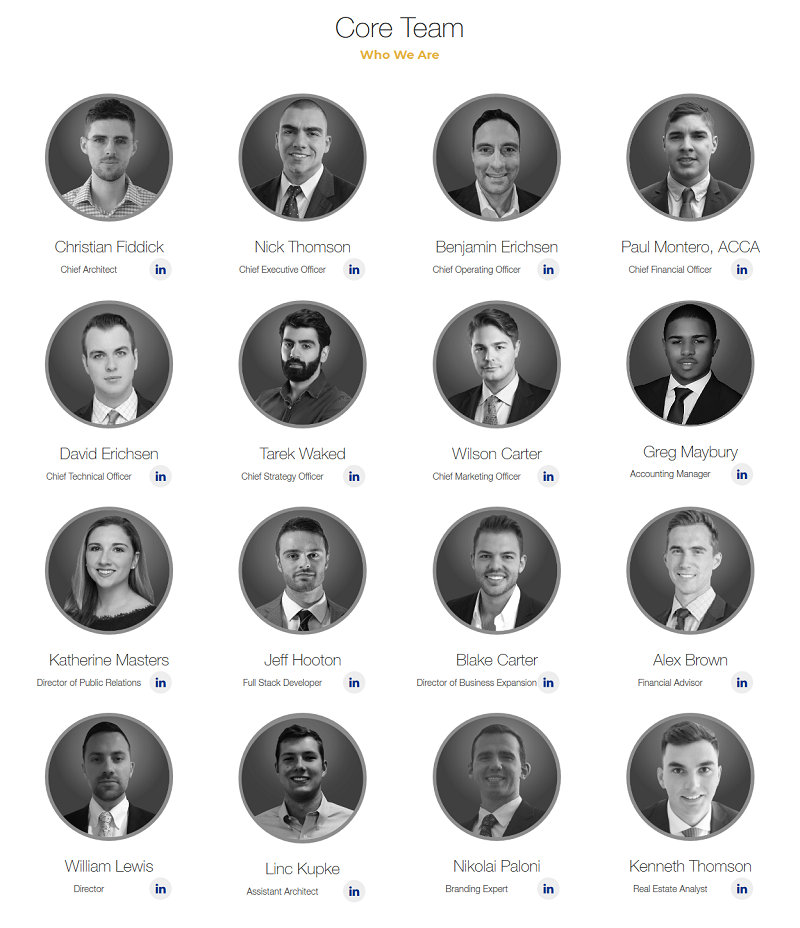

The management team comprises highly qualified and experienced professionals in legal, financial, technology, online communication and IT. Following is a brief explanation on the CEO.

Nick Thomson ( CEO )

Nick was graduated in finance and hospitality management and he possesses more than five years of experience in diversified areas. He holds the position of managing director in LM development group as well.

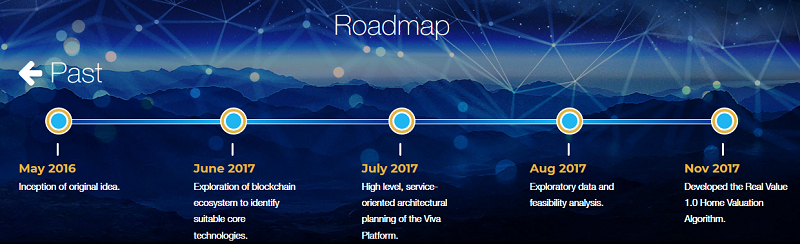

The team is confident that they would be able to launch their complete platform by the 2nd quarter of 2019.

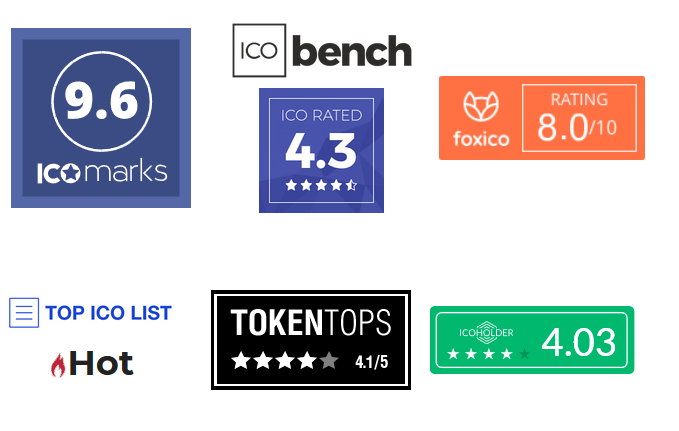

VIVA Network ICO Ratings

More Informations :

Website : http://www.vivanetwork.org

Whitepaper : http://www.vivanetwork.org/pdf/whitepaper.pdf

ANN Thread : https://bitcointalk.org/index.php?topic=3430485.0;all

Twitter : https://twitter.com/TheVivaNetwork

Facebook : https://www.facebook.com/VivaNetworkOfficial/

Telegram : http://t.me/Wearethevivanetwork

Medium : https://medium.com/@VivaNetwork

Reddit : https://www.reddit.com/r/TheVivaNetwork/

Github : https://github.com/viva-network/viva-tge

Website : http://www.vivanetwork.org

Whitepaper : http://www.vivanetwork.org/pdf/whitepaper.pdf

ANN Thread : https://bitcointalk.org/index.php?topic=3430485.0;all

Twitter : https://twitter.com/TheVivaNetwork

Facebook : https://www.facebook.com/VivaNetworkOfficial/

Telegram : http://t.me/Wearethevivanetwork

Medium : https://medium.com/@VivaNetwork

Reddit : https://www.reddit.com/r/TheVivaNetwork/

Github : https://github.com/viva-network/viva-tge

Written By Ansul

BTT Profil URL : https://bitcointalk.org/index.php?action=profile;u=1929748

Telegram : https://t.me/EllyZulkifly

Facebook : https://www.facebook.com/elly.uchiha

Twitter : https://twitter.com/EllyZulkifly_66

BTT Profil URL : https://bitcointalk.org/index.php?action=profile;u=1929748

Telegram : https://t.me/EllyZulkifly

Facebook : https://www.facebook.com/elly.uchiha

Twitter : https://twitter.com/EllyZulkifly_66

Komentar

Posting Komentar